Barrier-free banking - From branches to mobile apps accessible for all

December 7, 2023

While a few years ago we had to queue at the bank branch to deal with any of our financial matters, we can now check our account balance and bank statements, make transfers or manage investments, 24/7, just at the click of a button through the bank’s website or app. Payments have become easier too. Many of us don’t rely on physical cash anymore, and prefer contactless payments instead.

Technological advances have allowed banking products and services to become more efficient and convenient. But are they really easy for all?

Everyday tasks we often take for granted, like paying by card at the store, withdrawing cash at an ATM or transferring the rent can be a challenge for a large part of the population — around 1.3 billion to be exact.

That’s where designing for accessibility steps in.

Understanding accessibility

That’s right, 1.3 billion or 16% of the world’s population live with a disability and the number is expected to increase because people are living longer. As people age, they’re more likely to experience age-related conditions like hearing loss, cataracts or mobility impairments, which might change their abilities when interacting with digital products.

Even if you’re not living with a disability or you’re not part of the elderly population, you can still come across a temporary disability, such as a broken arm after a snow trip accident, or experience a situational limitation, such as being somewhere where you can’t listen to audio. If you can’t use your arm to move the mouse, you’ll need the website to be keyboard accessible. If you’re in the library and forgot your phones, you’ll need videos to have captions in order to understand what’s being said. In such cases, you’re taking advantage of disability-friendly features that were primarily intended for people who are blind or deaf. That’s why accessibility benefits us all. This idea has given origin to the term curb cut effect. Although a curb cut on a sidewalk is designed for people with physical disabilities, it also makes it easier for elderly people with low mobility, and for people with a baby stroller or carrying luggage.

The first step for any organisation looking to make their products or services more accessible is understanding the different types of disabilities, and most of all that not all people with disabilities are the same, nor need the same adjustments. The Web Accessibility Initiative by the World Wide Web Consortium (W3C) is a rich and reliable source of information regarding this subject.

When it comes to digital accessibility, it’s also important to understand that in order for people with disabilities to navigate the web they usually rely on assistive technology. Screen readers, for example, are software programs that allow people with visual impairments to perceive text and images displayed on a computer screen by rendering it as speech or Braille output.

What is accessible banking?

In the banking and financial industry, accessibility is about empowering everyone, including people with disabilities and the elderly, to enjoy bank’s products, services and facilities, by making them convenient and easy to use.

We believe banking accessibility must cover 5 major customer-bank touchpoints:

- Banking facilities and in-person services

- Banking documents (printed and digital)

- Bank cards and ATMs

- Customer communication

- Online banking and mobile apps

1. Banking facilities and services

Although our visits to bank branches have significantly reduced over the past few years due to the many services now available online, there’s still some activities like opening an account, hiring a loan or making an investment plan, that require our presence at the bank’s physical location.

In many countries, bank locations are already subject to mandatory accessibility regulations. That means the design, layout and construction of buildings should take into account people with disabilities, in particular people with mobility impairments, but not exclusively. Best practices might include:

- Low-level or adjustable height counters so that people with wheelchairs or people with different statures can access comfortably;

- If customers are expected to queue, providing seats so that the elderly or people with low mobility can wait more comfortably;

- Welcoming service dogs into the facilities;

- Providing ramps, handrails and lifts for people with mobility impairments;

- Have Braille or large print signage, for room numbers and directions, so people who are blind or have low vision can perceive the information;

Lift buttons with numbers in Braille. Image source: Freepik

- Providing hearing-induction loops to make communication with branch employees easier for people with a hearing aid;

In the UK, Barclays has at least one counter at each branch with a hearing-induction loop fitted and one portable device for discussions away from the counter. Image source: contacta

- Having easy grip pens available for people who find it hard to use their hands;

- Offering the possibility to order ink stamps of signature so people with mobility impairments can sign documents more easily.

2. Banking documents (printed and digital)

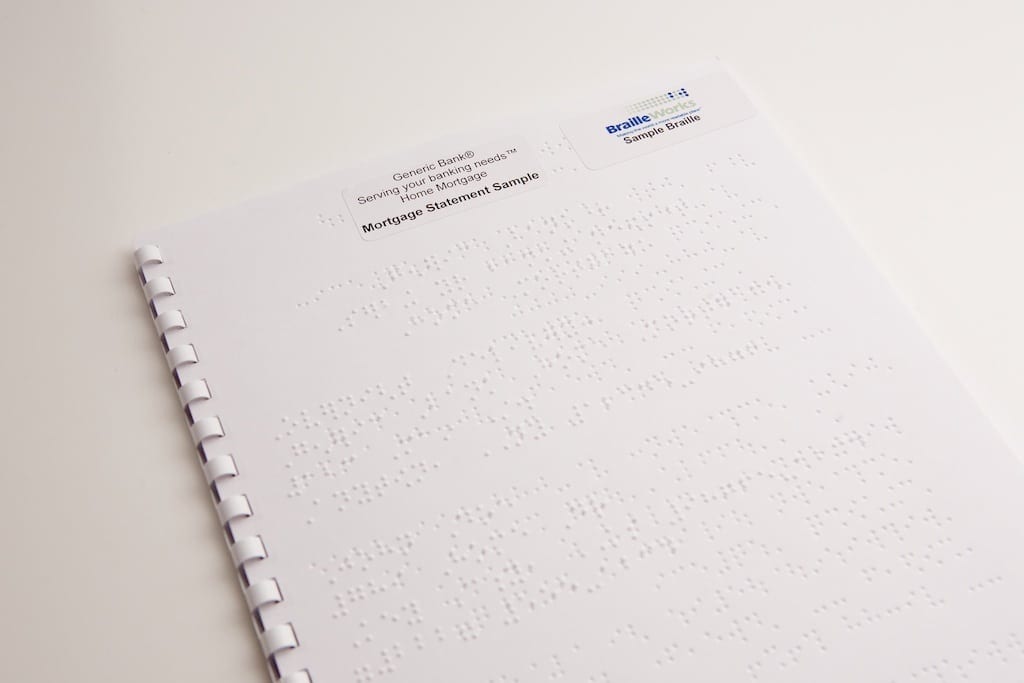

People who are blind or have low-vision won’t be able to read documentation handed out by the bank employee when they want to open a bank account or apply for a loan. That’s why bank communications such as account statements, card and PIN details or passcodes should be available in alternative formats. These might include Braille, large print, coloured paper, plain language and audio alternatives.

A sample braille mortgage statement by Braille Works

When it comes to financial documents provided in the bank’s website or through the app, PDF seems to be a preferred format. Possibly because it’s easy to distribute and makes formatting consistent. However, PDFs are normally inaccessible for people with disabilities using assistive technology.

While there’s no need to completely ban PDFs, you should consider if that’s the best form to share the information. If it’s a form, for example, Google Forms or a web form would be more accessible options. If the PDF is purely informational, the content might be shared on a web page as HTML is normally more accessible. If there’s no other option, PDFs can be used as long as documents are created for accessibility right from the start and before being converted into that format.

3. Bank cards and ATMs

If not accessible, ATMs might be a challenge for both people with motor impairments and for people who are blind or have low vision.

ATMs should be placed somewhere with no physical barriers (stairs, for example), and meet the height and reach requirements so that someone in a wheelchair can access it.

For people who can’t see the information on the screen, talking ATMs allow customers to plug in their earphones into an headphone jack on the ATM and receive audio instructions. Thus the application must be fully accessible by screen reading technology. Once they can hear the instructions, people who are blind should also be able to control it. That’s why ATM control buttons must have Braille — normally, a raised dot on the number 5 to identify the centre of the keypad, a raised circle on the “confirm” button and a raised cross on the “cancel” button.

The ATM application must also use accessible text (font type and size), and an appropriate colour with high contrast so people with low-vision can perceive the information on the screen.

To use an ATM you need, of course, a card. If you have no vision impairments, opening the wallet to get the credit or debit card you wish to use is clearly not an issue. Each has their own design and it’s easily recognisable. What about someone with low vision or who’s blind? How can they tell which is which in a wallet full of similar shaped cards?

ING’s payment card featuring a notch

In 2021, ING was the first bank in Belgium to introduce a payment card with a notch for customers with a visual impairment. This small but relevant feature allows people who have low vision or are blind to identify which card they're holding and which end they have to insert into an ATM or a payment terminal.

CaixaBank payment card featuring a notch and Braille.

Other option was taken by CaixaBank who issues Braille cards for people who are visually impaired. The card also has a notch to help customers position the card correctly at ATMs or POS. While it is not possible in the standard format to indicate the expiry date or the CVV, customers have a second card containing that data, essential if they want to make online purchases.

If the PIN is correct, the customer's phone delivers an audio confirmation of the transaction completion status.

A different step towards more accessible payments was taken by the Turkish bank Papara who launched the Voice Card, in 2023. With it, visually impaired customers can be sure they’re paying the right amount at a POS terminal. When customers receive the Voice Card, they just need to pair it with their phone via NFC. When they want to pay for an item at a point-of-sale terminal, they have to make sure their Bluetooth is on and they can then listen to the transaction amount.

4. Customer communication

Have you ever wondered how a person who’s deaf or has hearing impairments manages the communication with bank employees during a visit to a bank branch? To address this, several banks offer different options for their customers.

The Canadian bank BMO offers assistance from a professional Sign Language interpreter in their branches, free of charge. Customers who are deaf just need to request the presence of an interpreter at their next branch visit. They also support alternative ways of communicating such as note/message writing or bringing in a friend or family member as an interpreter.

In the UK, besides the option to book an appointment with an interpreter, Barclays offers 4 other options:

- If a customer has a lipspeaker, Barclays allows them to speak on their behalf when calling the bank teams. When a customer calls, Barclays sends a text message to confirm it’s them.

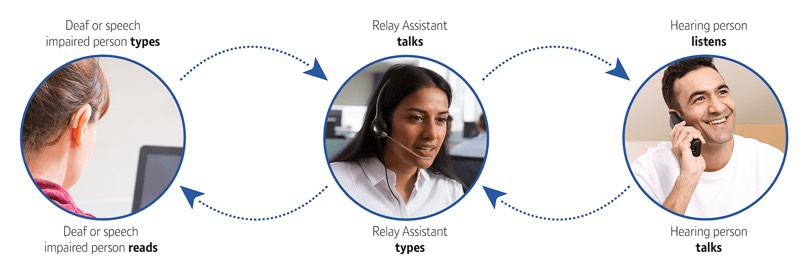

- Barclays also allows customers with hearing and speech difficulties to use the Relay UK service to access their services. When customers dial 18001 from their textphone or computer and enter the phone number they want to reach, an operator will join in the call and read the customer’s written request to the bank operator.

A typical call using Relay UK

- If the customer uses British Sign Language, they can use Barclays’ SignVideo service when calling the bank. The service connects them to an interpreter who can translate sign language to spoken word for the advisor.

- The SignVideo service is also available when a customer who’s deaf or hard of hearing has an appointment in a branch. Using the camera on their phone, tablet or laptop, the bank will connect them to a SignVideo interpreter,who’ll be able to relay the conversation to a banking advisor.

Barclays UK seems quite aware of the different conditions and disabilities of their customers and the need of tailoring their service to suit each customers’ needs. They encourage people to let them know of any specific requirements and they’ll then add a discrete and confidential note to the customer’s account, so employees know about it whenever they call or visit a branch. You can see how they tailored their services to a customer with Dyslexia in this video.

5. Online banking and mobile apps

Online and mobile banking can be particularly relevant for people with disabilities as it allows them to conduct banking transactions from the comfort of their own home, without taking the time and effort to go to a bank branch in person.

People with disabilities who use assistive technology need website and bank apps to be designed and built the right way, so they don’t come across barriers that prevent them to access their financial information.

Some of the most common accessibility issues people have to face when using websites or apps of financial institutions include:

- Complex language —Being an industry with many technical terms and acronyms, banks are long known for using complex language and jargon. That can be challenging for those who are proficient at the language, let alone for someone with poor reading comprehension or linguistic disabilities, or even customers who come from a different linguistic background (countries with a large number of immigrants, for example).

Making content accessible means keeping sentences short and avoiding jargon. A good practice can also include providing a glossary so customers can check definitions as they read.

The Spanish bank Bankinter has a glossary with economic and financial terms available on their website.

- Keyboard navigation — People who can’t use a mouse must be able to use a website with a keyboard. These users normally use the Tab key to navigate through interactive elements of a page (links, buttons, form fields, etc.). For them to navigate properly, a series of practices should be implemented, including:

- a visual indicator of which element has keyboard focus;

- the navigation order must follow the visual flow of the page;

- a “skip to main content” link that allows users to bypass large or repetitive blocks of content;

- a proper heading structure to make navigation easier as screen reader users can listen to a list of all headings and go straight to where they want.

Navigating with the keyboard in National Australia Bank website, with a “Skip to main content” link and elements being given keyboard focus.

- Login and form timeouts — For people with motor impairments or cognitive disabilities having a short amount of time to input the necessary information can be a hard task as they might need more time to type or read content. That’s why users should be alerted when the time limit approaches, and be given the chance to extend it or even turn it off.

- Application forms — Bank websites often have forms to apply for credit cards or to do loan simulations. However, there’s a lot that can go wrong with forms if they’re not designed and coded properly. Best practices include:

- form fields must be labeled so that people using screen readers know which information to input;

- mandatory fields must be clearly defined;

- long forms should be break down into smaller sections because filling in complex forms can be a daunting task for people with cognitive disabilities;

- errors should be clearly communicated, letting people know what’s wrong and how to fix it;

- errors or invalid fields can’t be indicated using colour alone.

- Consider screen readers — If websites are not coded properly, people using screen readers might not be able to perceive many of the elements (like text, buttons or images) present in each page. Images, for example, must include alt-text — the text describing the image that will be read when someone using a screen reader comes across it.

As a person who’s blind doing her banking online, Lily Mordaunt explains:

In addition to checking my transaction history, I might want to transfer money to a friend or pay a bill. The way to access these parts of the apps is through buttons. For example, suppose the button only has an image and no text. In that case, my screen reader will only read the word “button,” leaving me with no idea if I’m about to open Zelle [digital payments network] or my account settings.

Why is accessibility a must for a modern banking service?

Accessibility is not just a nice thing to do. It’s of major importance if banking institutions want to create high-quality experiences, and not exclude people from using their products and services.

Existing and upcoming legislation makes it mandatory

The European Accessibility Act (EAA) results of the need to create common, standardised accessibility requirements for all member states of the European Union, thus replacing the different accessibility rules each country was applying. The EAA covers several products and services, and prioritises digital products accessibility. Banking services are, of course, included. Countries had until June 2022 to apply the EAA to their national legislation. Now businesses have until June 2025 to comply with the laws and regulations.

“… this Directive should establish common accessibility requirements for certain banking and financial services provided to consumers.”

In other countries, like the US with the Americans with Disabilities Act (ADA) or the UK with the Equality Act 2010, accessibility is already a mandatory requirement.

It can attract new customers and build loyalty

With an aging population, the number of people with some form of disability will continue to increase. Existing customers will most likely continue to use banking services as they age, so addressing accessibility will ensure they will easily continue to do so.

More than 8 in 10 people with disabilities have chosen not to give their business to a service provider because of barriers. Frustrating experiences with an organisation will make customers walk away, and end up choosing a competitor.

Moreover, when people with disabilities have a negative experience with a brand, they often tell their friends and family, which will also influence their choice.

It affects a bank’s reputation and gives competitive advantage

By ensuring your banking services are accessible, you’ll not only be positioning yourself ahead of other financial institutions, but you’ll prove your commitment to breaking barriers and create a positive public impression.

Today’s potencial customers are more likely to do business with organisations who make diversity and inclusion a core value. Study shows seven in ten US Millennials actively consider company values when making a purchase — compared with 52% of all US online adults.

How to address digital accessibility in banking

Accessibility-first mindset

Many organisations mistakenly think of accessibility as something nice-to-have, and not worth the time, effort and money spent, thus keeping investment to a bare minimum.

An accessibility-first strategy rejects that idea and means that organisations see accessibility as a necessity. Accessibility is then considered and prioritised from the very beginning of each project, whether that project is building a new branch, designing and developing a new app or updating content on your website.

For this to happen you need to ensure accessibility is part of the knowledge base of everyone in your team, and it’s not just on the shoulders of a single designer or developer. When taking that path, you risk they’ll become that boring colleague who keeps calling out other colleagues about building inaccessible work or they’ll eventually take a leave or move to a different job and leave you short in accessibility knowledge.

One of the most valuable things when considering the needs and special abilities of all your potencial users is including them in your design process through focus groups, usability testing, and other research methods.

Build awareness and provide training

One of the main problems is that people working in the banking industry are not sufficiently aware of the challenges people with disabilities might face when reaching out for their services and products, whether physical or digital.

It’s then extremely important to build awareness around what accessibility looks like, both for people responsible for designing and implementing banking products as well as for those who receive customers at bank branches or talk to them over email or phone.

The Canadian bank HSBC has mandatory accessibility training for 8000 of their employees so they can be more aware of the need of their customers. The same happens at Laurentian Bank with team members having to complete annual training to build awareness on disability and accessibility.

Listen to your customers

A study conducted in the US, found that Internet users who are blind call a company’s customer service department once a week on average because of website inaccessibility. 90% of interviewees reported that they regularly call customer service multiple times to report an issue, even though they have already abandoned the transaction — and made the decision to use another company where possible.

When it comes to dealing with accessibility issues, don’t ignore feedback from your customers. Let’s take the example of someone who’s blind and is unable to use your website with their screen reader. Scenario 1: they might give up on you an simply look for a different bank offering a more accessible digital service. Scenario 2: they might contact you to let you know about the issues they're experiencing. Eventually, if they see their concerns haven’t been met, they might move to a new bank, or ultimately file a lawsuit against you for discrimination. In the United States, 2235 of the 11.000 ADA-related lawsuits were against financial services.

Responding and addressing customers’ complaints regarding accessibility issues, will ensure they are happy with your service and reduce your chances of having to face legal implications.

In Scotiabank’s website you’ll find a whole web page dedicated to making complains about their services. Also the Canadian Western Bank, explains how to give feedback on a web page solely dedicated to the accessibility feedback process.

Let customers know what to expect

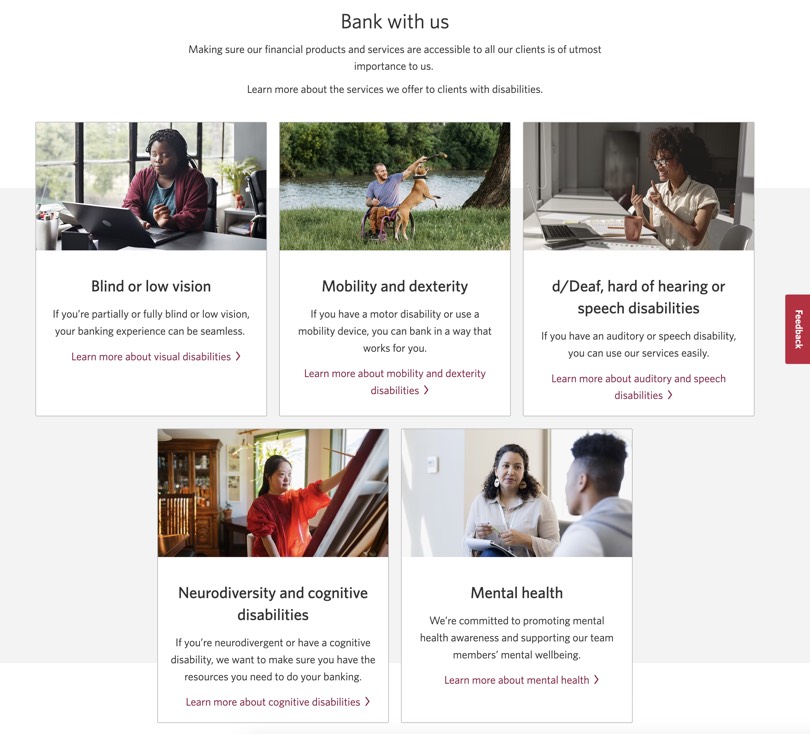

If you offer accessible features and options, let your customers or prospects know about it. This will make it easier for them to choose you or seek a competitor who better addresses their needs.

The Canadian bank CIBC shows its commitment towards accessibility in a dedicated web page where customers can learn more about the services the bank offers according to each disability.

Reach out to accessibility experts

Although you can train your in-house team to make your website or app accessible, web accessibility is a highly complex area. Most likely they won’t be able to get the necessary training and fix everything within a short time-frame. That’s why you can partner with an accessibility expert who will have the specialised knowledge to make sure your digital presence can be used without limitations. They’ll likely start by conducting an accessibility audit and let you know where users are encountering barriers. From there they’ll point you the right direction towards accessibility compliance.

Accessibility in Portuguese banks

It only takes a quick online search in the websites of several banks operating in Portugal to see there’s still a long road to go when it comes to adapting their services to people with disabilities.

From the ten websites of major banks we looked at, only five have a web page dedicated to accessibility. From those five, three focus mainly on digital accessibility, one only refers physical accessibility and another one talks about the effort to eliminate both physical and technological barriers.

Even those who claim to follow the recommendations by the WAI fail to accomplish them. Buttons without the proper label or images without an accessible alt are few examples of the common errors we found.

In the example on top, the button doesn’t have a proper label. When using a screen reader a blind user will only listen “button” and have no clue that’s the search feature. On the bottom we see an example of an image with a completely useless alt text. A screen reader user will listen “Info: image”. The image is also a link that allows you to access the loan simulation web page, something a blind user will be totally unaware of.

None of the websites of banks operating in Portugal seems to mention alternative ways of contact for people with impairments that can’t use traditional methods.

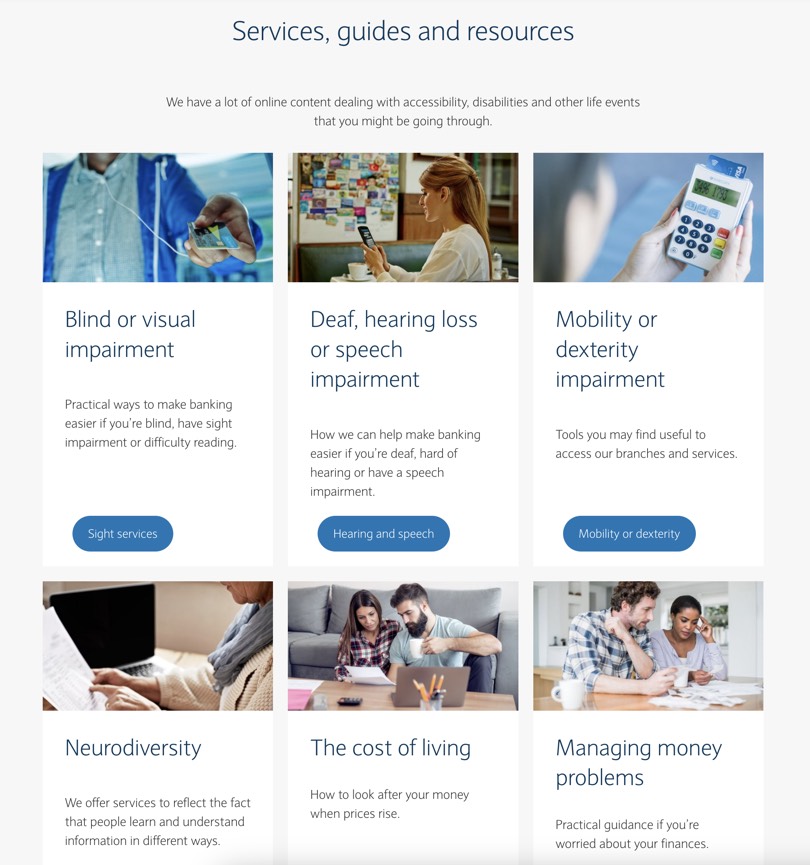

And after taking a look at websites from banks in other countries (such as Canada, the USA, the UK or Scotland) it’s pretty clear that they’re far behind when it comes to adapting their services to people with different disabilities. Several websites present the services they offer organised by disability, making it easier for people who have a given impairment to refer directly to the services the bank offers to address their needs.

CIBC and Barclays organise their webpages on accessibility by impairment.

In some countries, banking associations came together to define common standards to address accessibility. Take the example of the Australian Banking Association who wrote “Every customer counts — Accessibility Principles for Banking Services”, a document with principles to “ensure banking services in Australia are optimally placed to deliver the best accessibility and inclusive experience for their users”. Or the Canadian Bankers Association who was actively involved in the consultation process that led to the Accessible Canada Act of 2019.

Of course, we’re merely comparing the information banks provide on their websites regarding their accessibility endeavours. This also doesn’t mean banks operating in Portugal don’t address the needs of their customers with disabilities upon request. However, by being clear about which accessibility services they offer, banks are make it easier for people with impairments to make a better choice on which institution they want to make business with.

Accessibility pays off

From entertainment to learning, grocery shopping or job hunting, everything we do is digital these days. That includes personal finances and banking. Everyone, including people with disabilities and the elderly, have the same right tomanage their personal finances, apply for a loan or open a savings account independently, safely and with ease. That only happens if banking institutions start seeing accessibility as a must-have and building their products and services considering the different abilities of people using them.

If a person with a disability can’t simulate a mortgage or check the conditions of retirement savings plans, they’ll certainly not be willing to spend and trust their money with your organisation. However, if they’re offered a seamless experience, they’ll more likely to do business with you.

Public and private-sector European business have now less than two years to comply with the EAA. Better than rushing last minute, is being proactive and start accessing your products and services accessibility.

Ensuring people’s rights and building a more inclusive society concerns us all. Banking services can’t be an exception.

Want to offer a service accessible to everyone?

Xperienz can help you assess if all users can navigate and complete the necessary tasks on the website or app of your banking institution.

We perform accessibility audits to access compliance with WCAG guidelines, identifying errors and providing a possible resolution so they can be easily addressed by your team. We also conduct usability tests with users with disabilities to identify possible needs, difficulties or obstacles when using the website.

Tell me moreRelated Articles

-

Prompt-based — The birth of a new human-machine interaction model

The ways humans interact with technology has evolved significantly over the decades — and it’s still constantly evolving. The rise of Artificial Intelligence (AI) and natural language processing (NPL) has brought to light a new way of interaction — prompts.

-

A glimpse into the future — Here’s the UX design trends we expect to dominate 2024

Emerging technologies and tools constantly influence the way people use the Internet and interact with digital products. And as user behaviours and preferences evolve, designers must keep up with new tools and solutions to deliver interfaces and user experiences that cater the needs of an ever-demanding audience.

-

How can insurance companies make their digital products more accessible?

Millions of people who live with a disability struggle to access important information online because websites and apps are built with major content and technological barriers. And insurance websites are not an exception.

-

Barrier-free banking - From branches to mobile apps accessible for all

In the banking and financial industry, accessibility is about empowering everyone, including people with disabilities and the elderly, to enjoy bank's products, services and facilities, by making them convenient and easy to use.

-

Design for a better world - How working together and applying design approaches is improving people's lives

9 November is World Usability Day 2023. This year's theme is Collaboration and Cooperation, which intents to focus on how we can work together to create solutions, both globally and locally, to solve the world's biggest problems.

-

Be an Agent of Change - Check these resources to help you build more ethical designs

The role of today's designer goes far beyond simply creating beautiful interfaces and experiences. You can no longer design without considering the consequences of how what you're creating impacts individuals, society and the world.

-

E-commerce and Accessibility - Creating an inclusive online shopping experience

Now it’s the time for online stores to improve their website accessibility and ensure they offer an inclusive experience for everyone.

-

The future is today — How can we leverage AI to improve our UX Design work

AI has now become a big part of several areas of our lives, and UX Design is no exception. It’s actually becoming more and more applicable to the UX design process.

-

Conducting usability testing with people with disabilities

Drawing on our experience conducting usability tests with users with disabilities, we’re sharing a few things to take into account when planning and conducting research with people with disabilities and make sure everything goes smoothly and you can collect valuable insights.

-

Accessibility Compliance App - by Xperienz. A useful tool when fixing accessibility errors

To simplify the presentation of the accessibility evaluation of websites, Xperienz has created the Accessibility Compliance App. We start by doing a content inventory in which we collect all the pages of the site. Then we evaluate each page and list all the aspects that need to be fixed.

-

What does the UX future hold? - Here's the UX Design trends we expect to dominate 2023

Businesses must stay up to date on emerging user experience and interface trends so we've selected 7 top trends that are already making, and will certainly continue to make, an impact on website and app development.

-

Raising Awareness for Web Accessibility [Infographic] — International Day of Persons with Disabilities

Last December 3 we celebrated the International Day of Persons with Disabilities. To help promote a more accessible Web we’ve put together an easy-to-digest infographic about Web Accessibility.

-

Why hiring external UX services even when you have an in-house UX team?

Even if you have an in-house UX design team, there might be times when additional resources and professional know-how can be useful. Bringing in an external UX team might be exactly what you need for your company to excel in all projects.

-

Health and UX: when design has a life-saving potential

A good experience with healthcare technology and services, that is both useful, accessible and reliable, can make a huge different in improving peoples’ well-being, as well as the work of healthcare professionals.

-

Trust — Breaking or Building it Through Design

Trust is more valuable now than ever. 68% say trusting a brand they buy or use is more important today than in the past (Edelman, 2019). We live in an ever-growing digitalised world, where we increasingly interact and transact online. At the same time we constantly crave for trust-based interactions in digital environments. Questions like "Will the personal data I provide here be misused?", " Will my email be used to spam me incessantly?" or "Do I really want to share my bank details to a website I've never heard about?" have certainly come to our mind more than once.

-

Innovation Sprint — Exploring and validating a business direction in 2 to 4 weeks

During an Innovation Sprint, a new method created by Xperienz, the Sprint team joins efforts with the organisation team and in 2 weeks (minimum) they identify three strategic business directions, taking into account the organisation’s current state and structure. These innovative ideas are prototyped and tested and in the end the organisation will know the best path to follow.

-

Creating accessible digital experiences

Accessibility is of major importance for organisations who deliver web products and tools. Accessibility issues can affect not only a website’s usability for people who have disabilities but also for those who don’t. By offering accessible products, organisations will show they are inclusive, reach a wider market, be legally compliant, and offer a better user experience. For everyone.

-

Quick & Dirty User Research

Tight timescales and budgets are no excuses to ditch user research altogether, specially when we all know it’s essential to make sure you deliver easy-to-use products. Quick and dirty research is a great way to get user insights fast and on a budget.

-

10 Bad User Research Practices You Will Want to Avoid

Some might think user research is as simple as watching people perform a few tasks on a website or asking them a few questions, but user research is definitely not walk in the park. Let’s go through some of the mistakes that can arise when planning and conducting research.

-

Responsive Illustrations

Can the same illustration be used the same way on a desktop screen, on a tablet or on a smartphone? How is it possible to make them look great on every screen without losing quality or the idea the brand is trying to convey?

-

UXLx Masters — Wrap-up

From 10 to 13 February attendees from 25 countries and 14 world-renowned UX experts joined online for 3 days of learning. The programme included 12 live masterclasses, 2 keynotes, 2 live podcasts, and more.

-

The Design Role in Digital Transformation

As the world keeps evolving and digital becomes more crucial to our everyday life, companies are feeling pressured to keep up and level up their game.

-

Why We Need Parametric UI Design Tools

In Design, parametric refers to a process based on algorithmic thinking that uses parameters and their interrelations to define a geometric form (which can be buttons, containers, panels, etc.).